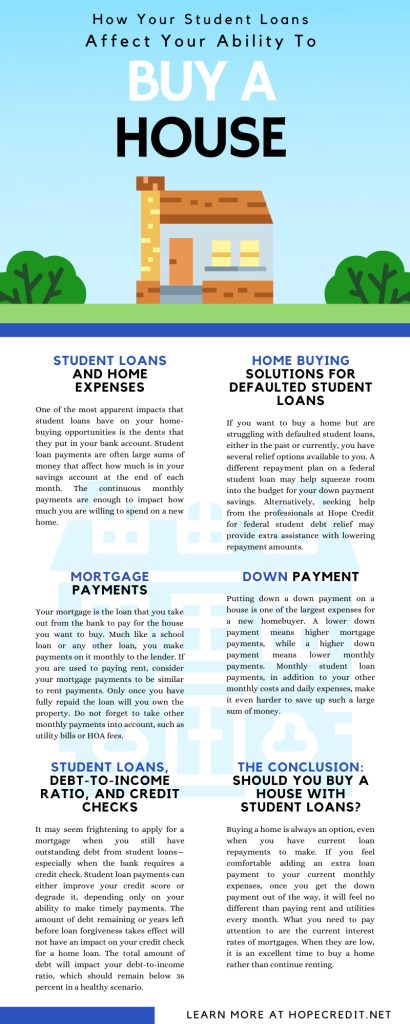

Student Loans Affect Your Ability To Buy a House. The most natural next step after finishing your college degree and securing a steady job is to buy a home or condo. Buying property for yourself provides more benefits than perpetually renting property. In addition to finally getting to design your home without limitations and not needing to deal with landlords, owning property and paying it off builds up your equity and credit score. With all that said, how do your student loans play into the reality of buying a home? You should not put your life on hold because of student loan payments. Knowing exactly how your student loans affect your ability to buy a house will help you balance your homebuying budget and get your life moving forward.

STUDENT LOANS AND HOME EXPENSES

One of the most apparent impacts that student loans have on your home-buying opportunities is the dents that they put in your bank account. Student loan payments are often large sums of money that affect how much is in your savings account at the end of each month. The continuous monthly payments are enough to impact how much you are willing to spend on a new home. As you continue to make payments on your student debt, your budget tightens, and it becomes harder to spend money on anything else. Two of the expenses you will need to put aside money for when buying a home include a down payment and mortgage payments.

Student Loan Down Payment

Putting down a down payment on a house is one of the largest expenses for a new homebuyer. The total amount of your down payment is a large singular payment agreed upon at closing that affects how much you will pay on monthly mortgage payments. A lower down payment means higher mortgage payments, while a higher down payment means lower monthly payments. It is important to set aside about 10-20 percent of the home’s price for this payment. For example, if you want to buy a $100,000 apartment, you should consider a down payment of $10,000-$20,000. It is possible to purchase a home with a smaller down payment, but at least a 10 percent down payment avoids additional costs.

Monthly student loan payments, in addition to your other monthly costs and daily expenses, make it even harder to save up such a large sum of money.

Mortgage Payments

Your mortgage is the loan that you take out from the bank to pay for the house you want to buy. Much like a school loan or any other loan, you make payments on it monthly to the lender. If you are used to paying rent, consider your mortgage payments to be similar to rent payments. Only once you have fully repaid the loan will you own the property.

Do not forget to take other monthly payments into account, such as utility bills or HOA fees. HOA fees, or homeowner’s association fees, are payments specific to condo complexes, townhome communities, or subdivisions that provide services to you as the property’s owner. This can mean utility services, such as snow removal and lawn care, or luxury features, such as a community pool or park.

STUDENT LOANS, DEBT-TO-INCOME RATIO, AND CREDIT CHECKS

It may seem frightening to apply for a mortgage when you still have outstanding debt from student loans—especially when the bank requires a credit check. Student loan payments can either improve your credit score or degrade it, depending only on your ability to make timely payments. The amount of debt remaining or years left before loan forgiveness takes effect will not have an impact on your credit check for a home loan. The total amount of debt will impact your debt-to-income ratio, which should remain below 36 percent in a healthy scenario.

How your student loans affect your ability to buy a house only depends on whether you can meet your consistent repayments. As your credit is checked, they look for how reliable you are with repayments and score based on a long history of repaid bills, loans, and credit cards. This fact is why many sources recommend acquiring a credit card early on, even if you do not use it for much. The fact that you can repay a credit card bill or a student loan payment shows potential lenders that you are capable of handling payments.

Defaulted loan payments harm your credit score. If your credit score is low enough, it will prevent you from getting credit cards, purchasing vehicles, and buying property. A lower than average credit score may raise your interest rate on a mortgage, which in turn raises the total amount that you will pay in the end with extra interest.

HOME BUYING SOLUTIONS FOR DEFAULTED STUDENT LOANS

If you want to buy a home but are struggling with defaulted student loans, either in the past or currently, you have several relief options available to you. A different repayment plan on a federal student loan may help squeeze room into the budget for your down payment savings. Alternatively, seeking help from the professionals at Hope Credit for federal student debt relief may provide extra assistance with lowering repayment amounts.

Private student loans are often trickier, as you will not get government assistance on them. However, private loans have more options and flexibility when it comes to refinancing and settling. Seek out professional help to free yourself from private lenders and save both your debt-to-income ratio and credit score. Once you feel that you are in a comfortable position to take on more loans, you can look into buying a home.

THE CONCLUSION: SHOULD YOU BUY A HOUSE WITH STUDENT LOANS?

Buying a home is always an option, even when you have current loan repayments to make. If you feel comfortable adding an extra loan payment to your current monthly expenses, once you get the down payment out of the way, it will feel no different than paying rent and utilities every month.

What you need to pay attention to are the current interest rates of mortgages. When they are low, it is an excellent time to buy a home rather than continue renting. Often, a mortgage payment will be cheaper than a landlord’s rent rates. You can generally get more from a house for the same amount you are paying now for rent. During the pandemic especially, houses became more affordable than they have been in recent history.

If you obtain a high interest rate due to poor credit from unpaid student loans, you can refinance in the future once you have gotten student loan assistance and fixed your credit. Take care of your current student loans and relieve the weight of debt from your shoulders by seeking help from Hope Credit. Our professionals will work hard to ensure your future as a homeowner is secured.

Hope Credit can provide you with student loan professionals who can get you through the fear and doubt.

CALL FOR A FREE QUOTE: (760) 916-9313 Or Contact Us: HopeCredit.net/contact-us/