News & Updates

Parent PLUS Loans and IBR: The New Pathway

How Parent PLUS borrowers can access Income-Based Repayment after consolidation through the ICR grandfathering provision. Includes the two-gate eligibility system, step-by-step pathway, and key deadlines.

Federal Register Updates - Student Loan Regulatory Changes

Track the latest Federal Register updates affecting student loan borrowers, including regulatory changes, comment periods, and implementation timelines.

Important Dates - Student Loan Deadlines & Milestones

Key dates and deadlines for student loan borrowers including repayment milestones, program deadlines, and regulatory timelines.

Student Loan Servicer Performance Analysis

Comprehensive analysis of student loan servicer performance data, error rates, and accountability metrics from 2015-2024.

Student Loan Delinquency Rates - Statistical Analysis

In-depth statistical analysis of student loan delinquency rates, trends, and their impact on borrowers across different demographics.

SAVE Plan Legal Impact Analysis

Analysis of ongoing legal challenges to the SAVE plan, court rulings, and the impact on student loan borrowers and repayment options.

Foreign Student Loans - International Student Loan Statistics

Statistical overview of international student loan debt, trends in foreign student borrowing, and the impact on the broader student loan landscape.

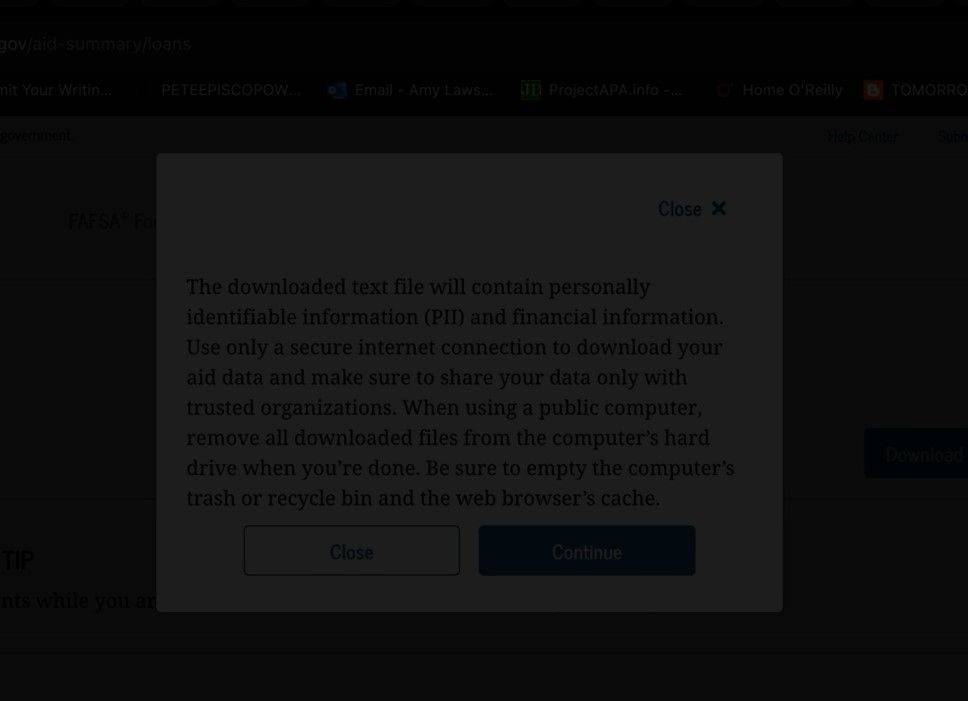

How To Access and Download your Federal Student Loan data file

How To Access and Download your Federal Student Loan data file There are many different reasons you may need to download your federal student loan data text file. Although the process may be a little different on all devices, this walk through should help all users effectively retrieve their federal

Over $23 Million in Forgiveness Since November of 2021!

Historic Achievement for Hope Credit Clients: Over $23 Million in Forgiveness As we approach the crucial July 1, 2024, date for the official implementation of the Department of Education’s IDR Account Adjustment, Hope Credit is pleased to announce the forgiveness of more than $23 million in student

DEADLINE: WHAT BENEFITS ARE EXPIRING ON 12/31/2023?

## Student Loan Forgiveness: Urgent Deadline for FFEL and Parent Plus Loan Borrowers April 30, 2024: Key Deadline for Student Loan Consolidation April 30, 2024, is the new deadline to consolidate FFEL or Parent Plus loans into a Direct Consolidation Loan to remain eligible for the IDR One-Time Accou

Student Loan Forgiveness 2024: New Programs and Expanded Benefits

Student Loan Forgiveness 2024. In the past few months leading up to the return to repayment, student loan borrowers have seen significant new benefits aimed at reducing repayment costs and increasing student loan forgiveness. Now, the U.S. Department of Education is pushing for even more targeted fo

The New SAVE Repayment Program: Lower Payments & Student Loan Forgiveness

The New SAVE Repayment Program: What Borrowers Need to Know On August 1, 2023, the U.S. Department of Education launched the SAVE repayment program, replacing the REPAYE program. This new plan is designed to provide more generous benefits for student loan borrowers. Below are the key aspects of this

Betsy Devos Loses Lawsuit Regarding Student Loans

IntroductionSecuring student loan forgiveness can be a difficult process. Recently, a significant legal victory was achieved by 19 states and the District of Columbia. They sued Betsy DeVos’ Department of Education over its failure to implement a rule that would protect borrowers harmed by for-profi

Update: Federal Court Blocks Further Forgiveness And Payment Reductions

UPDATE: Federal court blocks further forgiveness and payment reductions under the new SAVE program. 10th Circuit Court of Appeals Partially Reverses Injunction. UPDATE: This article has been updated June 30th to reflect the U.S. 10th Circuit Court of Appeal’s action to stay the injunction placed on

US DOE Announces IDR Adjustment To Forgive 804,000 Borrowers Due To Time In Repayment

What is the IDR Account Adjustment? A Multi-Step Approach to Fix Student Loan Repayment Tracking IDR Account Adjustment: On July 14th, 2023, the U.S. Department of Education announced the latest implementation of the multi-step approachto address longstanding failures associated with student loan pa

US SUPREME COURT RULES AGAINST DOE AUTHORITY TO IMPLEMENT BLANKET LOAN FORGIVENESS

Supreme Court Halts DOE Blanket Loan Forgiveness Court Halts DOE Forgiveness Court Halts DOE Forgiveness has sent shockwaves through the student loan community. On June 30th, 2023, the United States Supreme Court ruled against the Department of Education’s plan to implement a blanket student loan fo

Student Loan Covid Forbearance Ends As A Result Of Federal Budget And Debt Ceiling Compromise

Student Loan Forbearance Ends. Understanding Covid-19 On June 3rd, 2023, the President of the United States signed the Fiscal Responsibility Act of 2023 into law. This legislation officially ends the Covid-19 forbearance and prohibits the Secretary of Education from extending the suspension of stude

PSLF FORGIVENESS UPDATE: MOHELA IS SENDING APPROVAL LETTERS BY MAIL ONLY

Beginning Sunday January 1st, 2023 (which was a holiday), the student loan servicer responsible for facilitating the Public Service Loan Forgiveness program began sending notifications to successful PSLF Waiver candidates that their loans have been forgiven in full. Fedloan Servicing, the previous s

U.S. DEPARTMENT OF EDUCATION CLARIFIES THE SENDING OF ERRONEOUS FORGIVENESS APPROVAL MASS EMAILS TO STUDENT LOAN BORROWERS, BLAMES “VENDOR ERROR”

Student Loan Forgiveness Error. Beginning Tuesday, November 22, 2022, over nine million student loan borrowers received emails confirming the approval of their student loan forgiveness applications—whether they had applied or not. Many borrowers who never submitted an application for the blanket for

PSLF Waiver - Limited Time Student Loan Debt Waiver

According to the U.S. Department of Education, the PSLF Waiver program could benefit more than half a million student loan borrowers once they consolidate into the Direct Loan Program.