Total Client Forgiveness Since 2021

$30,219,418

GET FEDERAL STUDENT LOAN HELP

Many borrowers struggle needlessly due to a lack of information regarding the different and ever changing options that are available to get rid of debt once and for all.

$718,298

Monthly Savings

4,798

Consolidations

69%

Clients Paying $0 Monthly

$30,219,418

Total Forgiveness

Your Rights. Our Expertise. Federal Law Is On Your Side.

What We Do

Our Services

Consolidation

Strategic federal loan consolidation can simplify your repayment, unlock forgiveness programs, and reduce overall costs. We analyze your full loan portfolio to determine if consolidation is right for you.

- Combine multiple federal loans into a single Direct Consolidation Loan

- Cost & benefit analysis with weighted average interest breakdown

- Unlock forgiveness pathways for previously ineligible loans

Income Based Program Navigation

Multiple income-driven repayment plans exist, each with different eligibility rules, payment formulas, and forgiveness timelines. We navigate the complexity so you don't have to.

- Evaluate every active IDR plan — SAVE, PAYE, IBR, ICR

- Calculate your exact monthly payment before you enroll

- Compare total cost and projected forgiveness across all plans

Public Service Loan Forgiveness

PSLF offers complete loan forgiveness after 120 qualifying payments for borrowers working in public service. We help federal employees, nonprofit workers, and educators maximize this benefit.

- Federal employees, nonprofit workers, and educators eligible

- Employment certification, payment counts, and servicer transfers

- Projected forgiveness amount and optimal repayment plan analysis

Loan Forgiveness

Beyond PSLF, multiple federal forgiveness programs can eliminate part or all of your student loan debt. We analyze your eligibility across every available program and guide you through the process.

- IDR forgiveness, Borrower Defense, TPD, and closed school discharge

- Current policy updates, limited waivers, and new relief programs

- Full financial picture — what you pay, what gets forgiven, and the timeline

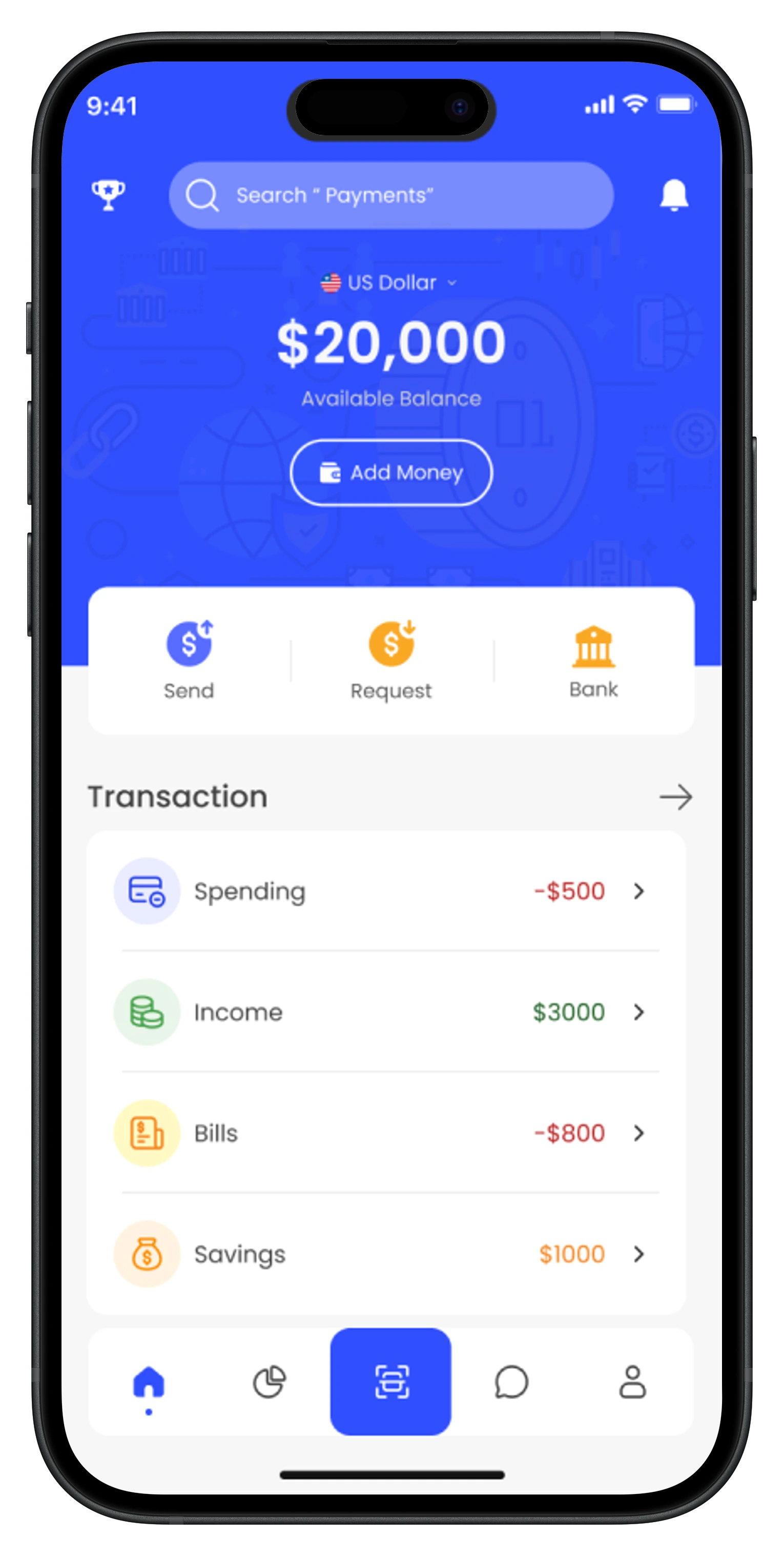

Hope Hero App

Your Services, In Your Pocket

The Hope Hero app puts everything you need at your fingertips — complementing our services with instant access to tools, documents, and progress tracking.

Full Calculator Access

Run unlimited payment scenarios across every IDR plan

Document Management

Upload, store, and access your loan documents anytime

Forgiveness Timeline

Track your progress toward forgiveness milestones

Credit Check

Vantage 3.0 trimerge credit report for subscribers

AI Document Analysis

Upload your MSD file for instant AI-powered loan analysis

Available Everywhere

iOS, Android, and web — one account across all devices

Pricing

Simple, transparent pricing. No surprises.

Free Trial

7 days

Free

FEATURES

- Decision Engine

- Document Checker

- Review your loan situation

- Identify forgiveness options

- Calculate potential savings

- Explain available programs

Self Service

$49/mo

FEATURES

- Everything in Free Trial, plus...

- Free Vantage 3.0 Trimerge Credit Report

Full Submission Client

+ $350 one-time setup fee

$49/mo

FEATURES

- Dedicated Case Worker

- Everything in Self Service, plus...

- Full loan portfolio analysis

- Income-driven repayment enrollment

- Servicer communication handling

- Document preparation

- Money back guarantee

- Ongoing support through approval

FEATURES

- Offer student loan assistance as an employee benefit

- Leverage SECURE Act 2.0 employer tax advantages

- Help your clients resolve federal student loan issues

- Dedicated account manager

- Custom reporting and program updates

- Volume-based pricing

Video Shout Outs

Visit our YouTube channel for more video reviews and other topics

Frequently Asked Questions

There is much confusion surrounding federal student loan debt and how it work. Many borrower are unaware of some basic aspects and how they can impact a federal student loan borrower's financial standing. Here are some of the most common questions we get from federal student loan borrowers about how federal student loans work.

IDR Plans

Income-driven plans cap payments at 10-20% of discretionary income, with forgiveness after 20-25 years.

PSLF

Public Service Loan Forgiveness after 120 qualifying payments for eligible public servants.

10+ Years

Our team has helped thousands of borrowers navigate federal student loan programs since 2014.

Ready to Lower Your Student Loan Payments?

Stop struggling with unaffordable payments. Get your free consultation today and discover which income-driven repayment plan or forgiveness program is right for you.